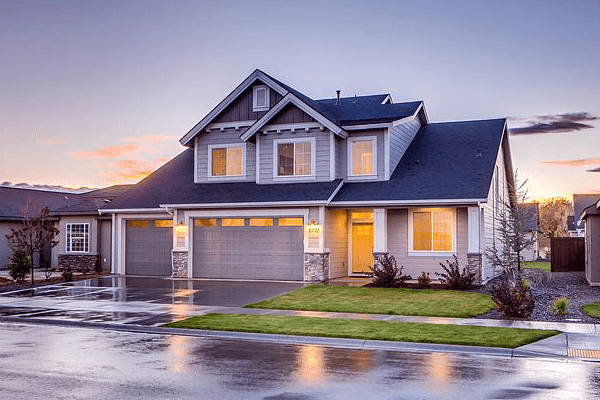

The Fall of Home Prices

Despite a 3% drop in home prices, monthly housing payments across the United States have reached a record high, fueled by increasing mortgage rates. According to Redfin, this price dip results from fluctuating market conditions, but it has yet to provide relief for homebuyers.

Housing Payments Continue to Rise

Several sources, including The Millennial Press, Paradise News, and The Epoch Times, confirm that rising housing payments have become a significant concern for Americans. This trend is particularly troubling given that it persists despite the fall in home prices.

Biden's Plan Under Fire

The Biden administration has recently been criticized for its policies that aim to help risky borrowers while raising costs for homebuyers with good credit. Newsweek reports that these policies are contributing to the spike in housing payments, further complicating the situation for potential homebuyers.

The Struggle to Make Ends Meet

As housing payments continue to rise, Americans need help to keep up. MarketWatch reveals that 39% of Americans have skipped meals to make housing payments, illustrating the severity of the issue.

Double-Digit Plunge in Home Prices

Some U.S. cities are expected to experience a double-digit plunge in home prices. According to the New York Post, this decline could contribute to an even more volatile housing market.

Warning Signs of a Recession

The unstable real estate market in the United States has led some experts to predict an impending recession. The Economist suggests that the current state of the property market could be an early indicator of economic troubles. This turbulence has particularly highlighted Gen Z homeownership challenges, as skyrocketing prices and rising interest rates make buying a home increasingly unattainable for younger generations. Many experts argue that limited access to affordable housing not only exacerbates generational wealth disparities but also weakens overall economic stability. If these trends persist, they may contribute to broader financial stress across various sectors.

In conclusion, the drop in home prices has done little to alleviate Americans' skyrocketing housing payments. Controversial policies and increasing mortgage rates have exacerbated the situation. As financial strain takes its toll, experts warn that the U.S. may be approaching a recession.

James Smith is our editor. He is an accomplished and versatile news writer with over a decade of experience covering a wide range of topics, including politics, business, and real estate. Throughout his career, James has been dedicated to uncovering the truth and presenting unbiased, factual reporting to his audience.